Vesting is a process where an individual earns the right to receive or take ownership of something over time, typically as an incentive or reward. It is an incentive program for employees that gives them benefits such stock options, retirement benefits when they have fulfilled a specified term of employment with the company.

For start-ups that highly depend on team members for success, vesting is an expedient way to sustain the business. By providing a time-based vesting schedule, the company can ensure loyalty and long-term security. Founders and other employees are typically subject to a vesting schedule for their stock. Some investors require it as a basis for their investment.

Recommended reading: Protect Your Brand with a Trademark: A Comprehensive Guide

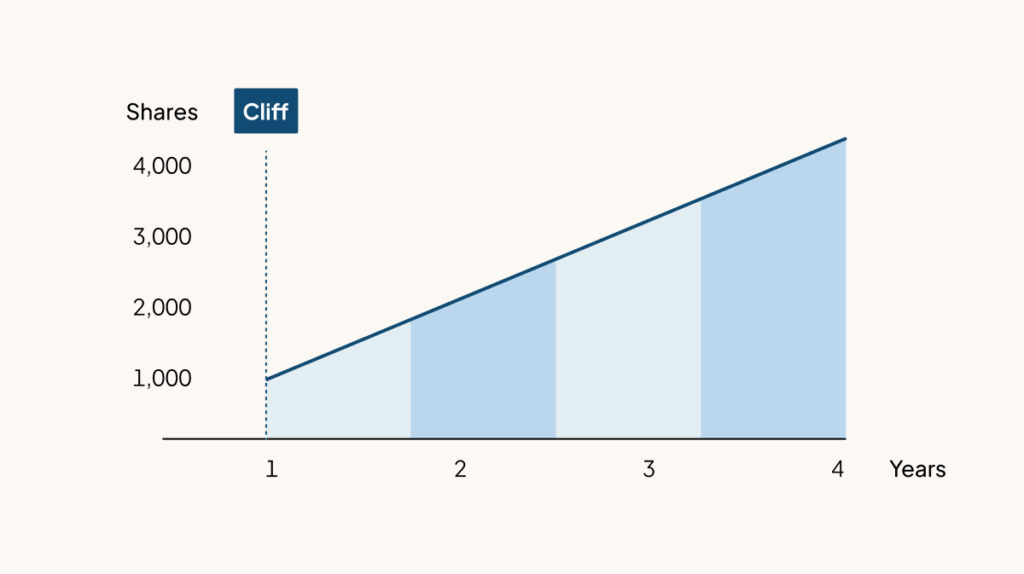

A vesting cliff is an agreed-upon date on which an individual can receive ownership of 100% of the stock. The vesting schedule set up by a company determines when founders or employees acquire full ownership of the asset. Typically, plans have a four-year vesting schedule plan with a one-year cliff.

HOW DOES VESTING WORK?

It works by creating a vesting schedule that allows founders or employees to access ownership of stock over an agreed-upon period. These schedules can vary widely depending on the company and the type of compensation involved, but they typically involve a combination of time-based and performance-based milestones that the individual must meet in order to fully vest their equity.

Recommended reading: Compliance for tech startup

For example, the company may offer an employee the right to purchase 1,000 shares of stock at a certain price but require that the employee work for the company for a number of years before they are entitled to exercise those options. Additionally, a founder may be subject to a vesting schedule such that if they leave the company before the vesting period, they lose their right to ownership of stock, property, or benefits.

During the vesting period, the individual is said to have a “vested interest” in the benefit, but they do not yet have full ownership of it. If the he or she leaves the company before the end of the vesting period, they may forfeit some or all of their rights to the benefit. Once the vesting period is complete, there is full ownership and control over the benefit, and can exercise their rights to it.

THE IMPORTANCE OF VESTING FOR STARTUPS

- Incentive for founders/employees

It encourages team members to stick together during difficult times. Most startups must go through hard times and in these situations, having an interest in the company is a compelling reason for them to stay on the team.

- Sustainability of the company

Another reason is for the sustainability of the company. Without vesting, if things don’t work out for a co-founder, he can walk away with his entire portion of the company and this might affect the other co-founders in the course of managing the business.

- Evaluation of staff performance

Vesting gives employers time to evaluate staff performance and let poorly performing employees go before they get the bulk of their equity payouts.

- Availability of money

Equity for employees is a substitute for cash bonuses and rewards. This enables the company to reserve a higher share of cash, which can be used to pay off current liabilities and in cases of emergency.

- Attraction of investors

Investors are more likely to invest in a startup that has a well-designed vesting schedule because it shows that the company has a plan for retaining its key employees and is committed to its long-term growth.

- Protection of intellectual property

Vesting can also help protect a startup’s intellectual property. By having employees vest in the company’s stock or options, the company can ensure that its key intellectual property remains within the organization even if an employee leaves.

CONCLUSION

As an entrepreneur, it is important to carefully consider the type of vesting that will work best for your company and to set up a clear and transparent vesting schedule to ensure the long-term success of your startup. Once founders opt to be subject to this, It is important to make a Section 83(b) election especially for Founders with a Delaware entity.

Sidebrief is a RegTech startup that has helped founders, entrepreneurs, and business owners across to streamline the process of launching and scaling their businesses. We provide the tools for founders to start and scale businesses across borders from a single interface . If want to make sure your equity is in good hands, contact us today.

For further information,

Email – [email protected]

Phone Number – +2349018081296