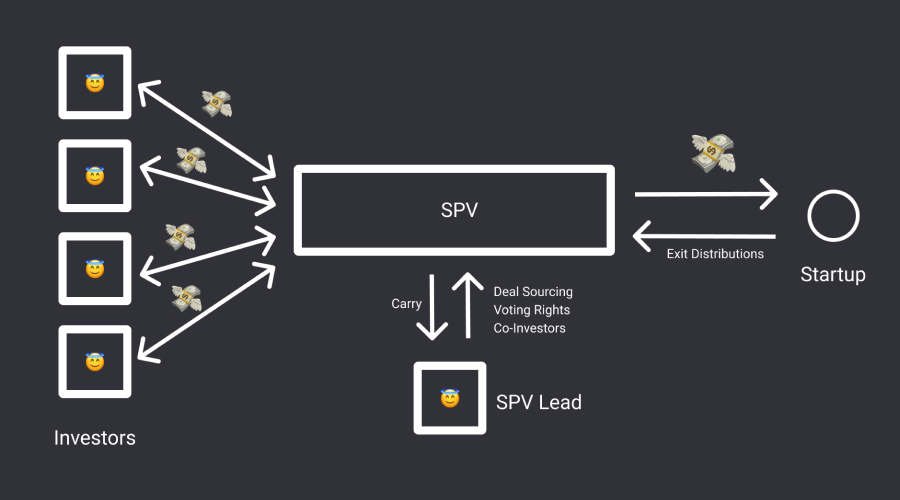

A Special Purpose Vehicle (SPV) is an entity set up by a parent company to undertake

a specific project or business activity. SPVs can be formed as a trust, a corporation, or a

limited partnership but are often structured as subsidiary companies. A SPV is a legal entity that allows multiple investors to pool their capital to make an investment in a single company.

Uses of Special Purpose Vehicle

The following are the most common reasons for creating SPVs:

1. Risk sharing: A corporation’s project may entail significant risks. Where a parent company wants to pursue a higher-risk project, forming an SPV is a good option to help isolate the risk and

protect the rest of the corporate group. If the higher-risk project becomes unsuccessful (resulting in default, debt or insolvency), a creditor can usually only bring a claim against

the SPV.

2. Securitization:One of the major uses of SPVs is to securitize risky investment pools. As a result, SPVs are popular vehicles for selling mortgage-backed and asset-backed securities.

3. Asset transfer: Certain types of assets can be hard to transfer. Thus, a company may create an SPV to own these assets. When they want to transfer the assets, they can simply sell the SPV

as part of a merger and acquisition process.

4. Raising Capital: SPV can be used to raise capital, with credit worthiness determined by the collateral of the SPV, rather than the credit rating of the parent firm.

5. Intellectual Property: SPV can be used to separate Intellectual Property into a separate structure, which has minimal liabilities and can be used to raise funds and enter into license agreements with third parties.

Benefits and Risks of Special Purpose Vehicle

As SPVs are distinct and separate legal entities, SPVs carry their own legal status, that

is the SPV can continue to operate even if the parent company goes bankrupt. SPVs are relatively easy to launch and incorporate, though regulations vary country to country.

However, there are some risks involved with using SPVs. One risk is the added complexity that comes with adding additional companies into a corporate structure. Managing an additional entity can be time-consuming and costly. You should weigh the benefits of incorporating an SPV against the added administrative burden of managing separate records, financial statements, and tax returns.

Another risk of incorporating an SPV is the risk to the parent company’s reputation if the

business or venture is high risk. A court can ‘pierce the corporate veil’ in cases of fraud

or improper conduct. Accordingly, a parent company is not always 100% protected.

Finally, an SPV may be a liability for the parent company. For example, the parent company might loan money or assets to the SPV to support its operational costs and provide working capital. Where the SPV has been formed to pursue a higher-risk project, there may be no return on investment for the parent company.

CONCLUSION

In conclusion, SPVs can be a useful tool for managing assets and liabilities and can provide benefits such as risk management and tax efficiency. However, it is important to consider the legal implications of using an SPV and to ensure that all regulatory requirements are met.

SIDEBRIEF

Sidebrief is a RegTech startup that has helped founders, entrepreneurs, and business

owners across borders register their companies with ease and comply with regulations. We provide the tools for founders to start and scale businesses across borders from a single interface. Simply sign up to get started.

For further information, contact us today.

Email – [email protected]

Phone Number – +2349018081296