U.S Venture Capital firms and foreign investors prefer to have their portfolio companies in a state in the United States called Delaware. This is the case even when they decide to invest out of North America and in emerging economies in Africa. For African founders who already have a company in their home country, this often means that they have to do a ‘ Delaware Flip’.

What is a Delaware Flip?

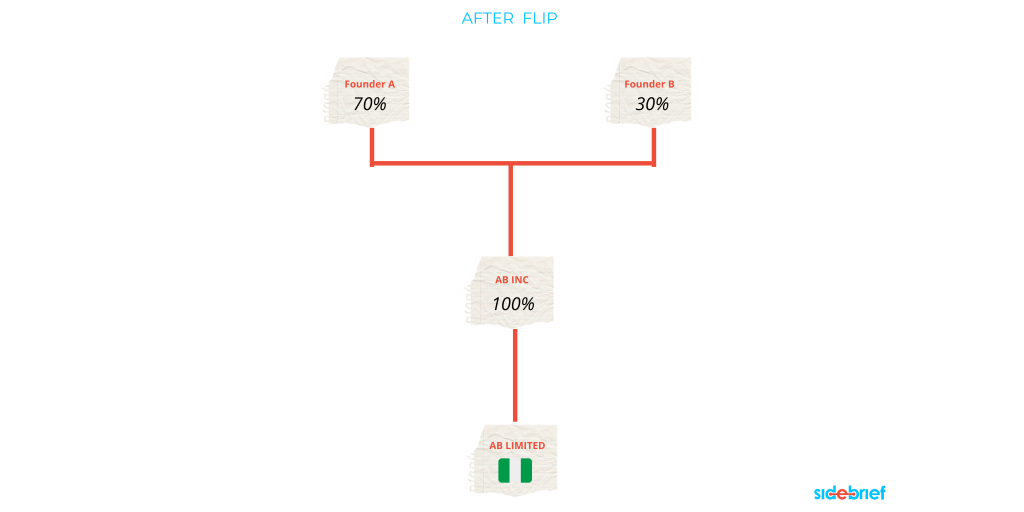

A “flip” involves formation of a Delaware corporation taxed under subchapter C of the Internal Revenue Code i.e. a Delaware C corp, and rendering the African entity as a subsidiary of Delaware C corp, with the goal of attracting U.S. investors.

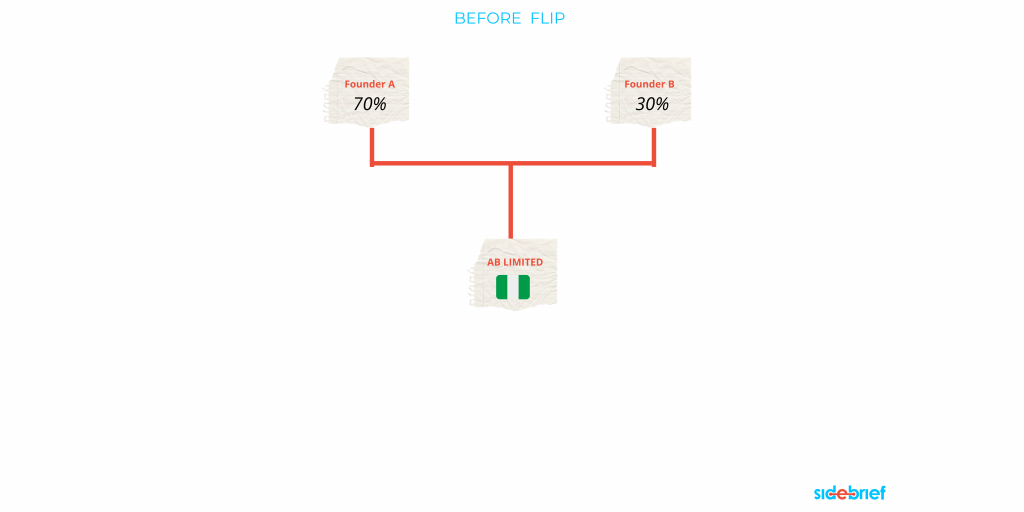

It involves incorporating a Delaware company and issuing shares in that entity to investors and founders, reflecting their respective shareholdings in the local entity at the time of incorporation. Thus, if Founder A and B own 70% and 30% respectively in ‘AB Limited’, a Nigerian company, their shares will be transferred to a newly incorporated Delaware entity called ‘AB Incorporated’, while they will now hold then hold stock in the same proportion in the newly incorporated company. In essence Founder A and Founder B will now own 70% and 30% stock in AB Inc while A & B Limited will be owned 100% by AB Inc. After this flip. The founders are able to raise money using A & B Inc. while they trade in their home country, using AB Limited.

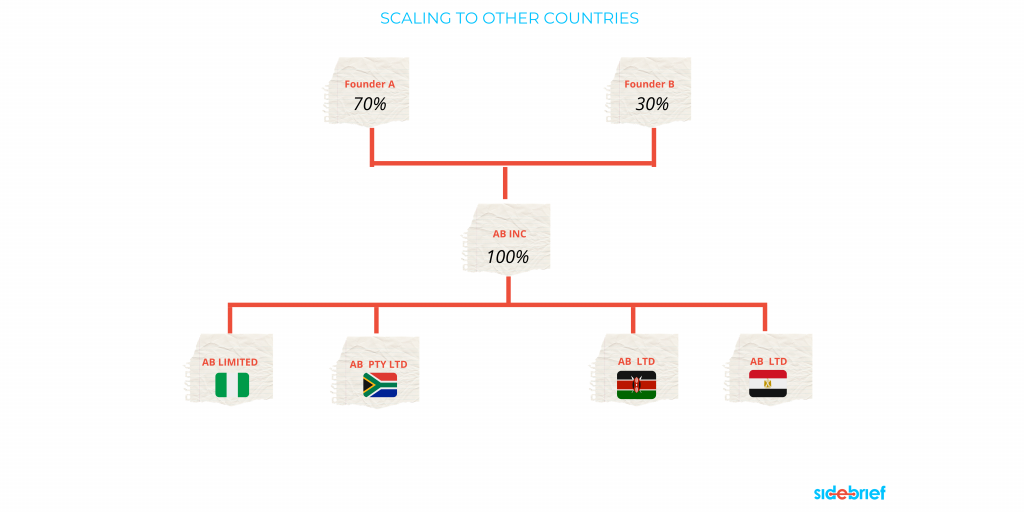

When expanding beyond their borders, the flip will typically look like the

Why do companies Flip to Delaware?

- It increases chance of investment:

This is the most important reason why companies that already have a company in their local country flip to Delaware. Raising capital is a necessary goal for every future startup as it helps with traction and growth; as such, companies like 54gene, Credpal, Shuttlers, Lendha among other have incorporated in Delaware have all attracted investors and investment.

- It is easier to get cash for shares:

When a company flips to Delaware, it is easier for the subsidiary companies to get cash for the shares in which they have invested. To flip to Delaware, it also makes it easy to buy out of the investment and offers a great opportunity to exist the investment when need arises

- The laws and regulations are favorable to startups and investors.

The law for setting up a Delaware company is favorable for investment as the laws and court systems are easy to navigate. Many founders seek to flip and incorporate in Delaware for this reason. Why haven’t you flip your company to Delaware?

Why do startups incorporate in Delaware?

Startups that have not been incorporated in their location jurisdiction or are looking to incorporate should consider incorporating in a Delaware. Incorporation in Delaware, just like Delaware flip, offers the same benefits, which include: It is easier to raise money as it attracts investors, It is easier for subsidiaries to get cash for the shares and the laws and regulations are favorable on shares and stocks for startups and investors.

Annual compliance requirement for Delaware Company

The three (3) main requirements for Companies registered in Delaware. Start ups are required to pay franchise tax, annual file report, and have a registered agent.

- Franchise Tax:

The word “Franchise Tax” does not mean that your business is a franchise. It simply means it has a Delaware Franchise Tax obligation. All businesses registered in Delaware must pay this tax, no matter how much money they make or how they are set up.

The franchise tax is a tax levied by the state of Delaware for the right or privilege of owning a Delaware corporation. The tax has no reference to income or business activity, it is only required by the State of Delaware to keep your company in good standing.

Find out more on more on Delaware franchise tax here

- Annual report:

The state of Delaware requires that every company file an annual report which should contain the physical address of the company, the name, and address of one of its officers, the name and address of all directors, and authorization by an officer to file the report. The annual report should be filed on or before March 1st every year.

- Registered agent

Delaware state law requires that all Delaware companies retain a Delaware agent. This registered agent acts as a liaison between the company and the state and bears the responsibility of receiving and forwarding the service of process and correspondence, which includes franchise tax notices etc. Also, the registered agent notifies and assists the company registered in Delaware on compliance and annual report filing.

Sidebrief

Sidebrief is a RegTech startup that makes business registration and compliance easy for founders, entrepreneurs, and business owners across Africa by removing lengthy paperwork, complexity, and hidden fees. We provide the tools for founders to start and scale businesses across borders from a single interface.